Introduction

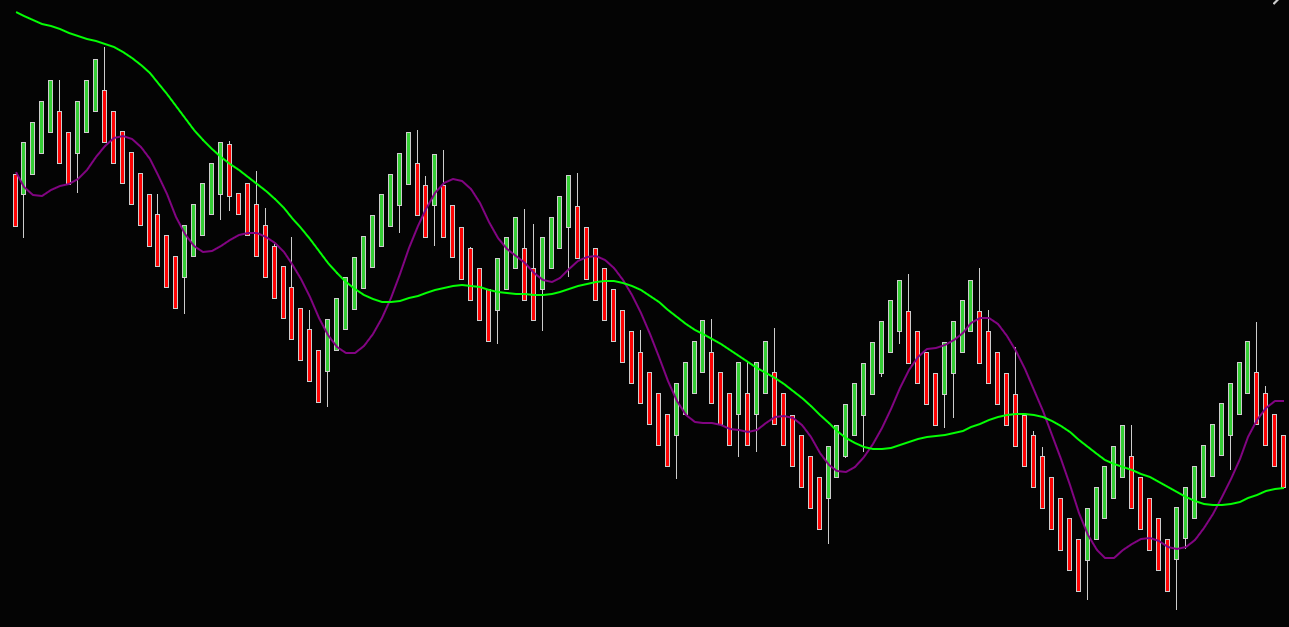

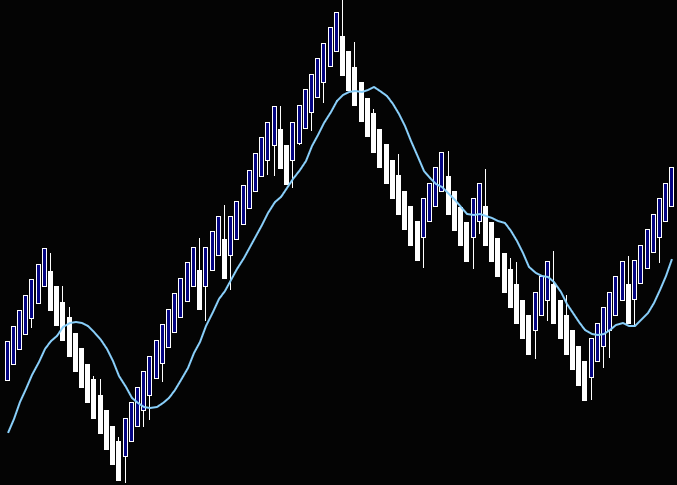

The Hull Moving Average (HMA) has revolutionized how traders analyze price action in futures markets. This powerful technical indicator, developed by Alan Hull in 2005, addresses the lag issues common to traditional moving averages while maintaining smooth price action representation. In this comprehensive guide, we’ll explore everything you need to know about implementing the HMA in your trading strategies.

Who Created the Hull Moving Average?

Alan Hull, an Australian mathematician and trader, developed the Hull Moving Average in 2005. Frustrated with the significant lag in traditional moving averages, Hull sought to create an indicator that could maintain smoothness while significantly reducing delay in trend identification. His mathematical background enabled him to develop this innovative solution that has since become a staple in many traders’ technical analysis toolkits.

What is the Hull Moving Average?

The Hull Moving Average is a technical indicator that combines weighted moving averages in a unique way to reduce lag while maintaining smooth price action representation. The formula for the HMA is:

HMA = WMA(2 × WMA(n/2) – WMA(n)), sqrt(n)

Where:

- WMA = Weighted Moving Average

- n = the chosen period length

- sqrt(n) = square root of the period length

Why Use the Hull Moving Average?

Key Advantages:

- Reduced Lag: HMA responds to price changes faster than traditional moving averages

- Smooth Output: Despite its responsiveness, HMA maintains a smooth line without excessive noise

- Trend Identification: Excellent for identifying both trend direction and potential reversal points

- Versatility: Applicable across different timeframes and market conditions

- Algorithmic Implementation: Well-suited for automated trading systems

Where to Apply the Hull Moving Average?

The HMA is particularly effective in:

- Futures Markets

- Forex Trading

- Stock Markets

- Cryptocurrency Trading

- Commodity Trading

When to Use the Hull Moving Average?

Optimal Conditions:

- Trend Following: During strong trending markets

- Market Reversals: For early identification of potential trend changes

- Range-Bound Markets: To identify breakout possibilities

- Multiple Timeframe Analysis: For confirmation across different time horizons

How to Implement HMA in Automated Trading Strategies

Basic Implementation Steps:

- Signal Generation:

- Trend Direction: HMA slope analysis

- Entry Points: Price crossing HMA

- Exit Points: Reverse crossing or target achievement

- Strategy Components:

/// <summary>

/// Implementation of Hull Moving Average (HMA) indicator

/// Formula: HMA = WMA(2 × WMA(n/2) - WMA(n)), sqrt(n)

/// </summary>

public class HullMovingAverage

{

/// <summary>

/// Calculates Hull Moving Average for the given price data and period

/// </summary>

/// <param name="prices">List of price data</param>

/// <param name="period">HMA period</param>

/// <returns>List of HMA values</returns>

public static List<decimal> Calculate(List<decimal> prices, int period)

{

if (prices == null || prices.Count < period)

throw new ArgumentException("Insufficient price data for HMA calculation");

// Step 1: Calculate WMA with period/2 (faster period half)

int halfPeriod = period / 2;

var wmaPeriodHalf = CalculateWMA(prices, halfPeriod);

// Step 2: Calculate WMA with full period (slower period full)

var wmaPeriodFull = CalculateWMA(prices, period);

// Step 3: Calculate 2 × WMA(n/2) - WMA(n)

var diffSequence = new List<decimal>();

int minLength = Math.Min(wmaPeriodHalf.Count, wmaPeriodFull.Count);

for (int i = 0; i < minLength; i++)

{

// This is the key HMA formula component

decimal hullValue = 2 * wmaPeriodHalf[i] - wmaPeriodFull[i];

diffSequence.Add(hullValue);

}

// Step 4: Final HMA = WMA of diffSequence with sqrt(period)

int sqrtPeriod = (int)Math.Sqrt(period);

var hma = CalculateWMA(diffSequence, sqrtPeriod);

return hma;

}

/// <summary>

/// Calculates Weighted Moving Average

/// </summary>

private static List<decimal> CalculateWMA(List<decimal> data, int period)

{

var wma = new List<decimal>();

decimal denominator = period * (period + 1) / 2m; // Sum of weights

for (int i = 0; i <= data.Count - period; i++)

{

decimal sum = 0;

// Calculate weighted sum

for (int j = 0; j < period; j++)

{

// Weight decreases linearly from period to 1

int weight = period - j;

sum += data[i + j] * weight;

}

wma.Add(sum / denominator);

}

return wma;

}

/// <summary>

/// Gets the latest HMA value for real-time calculations

/// </summary>

public static decimal GetLatestValue(List<decimal> prices, int period)

{

var hmaValues = Calculate(prices, period);

return hmaValues.LastOrDefault();

}

}- Risk Management Integration:

- Position Sizing based on volatility

- Stop-Loss placement using HMA as reference

- Profit targets aligned with trend strength

Example Implementation in C#

/// <summary>

/// Automated trading strategy using Hull Moving Average

/// </summary>

public class HMAStrategy

{

private readonly int _hmaPeriod;

private readonly decimal _stopLossPercentage;

private readonly decimal _takeProfitPercentage;

private readonly Queue<decimal> _priceBuffer;

private decimal? _lastHmaValue;

public HMAStrategy(int hmaPeriod = 20, decimal stopLossPercentage = 0.02m, decimal takeProfitPercentage = 0.03m)

{

_hmaPeriod = hmaPeriod;

_stopLossPercentage = stopLossPercentage;

_takeProfitPercentage = takeProfitPercentage;

_priceBuffer = new Queue<decimal>();

}

/// <summary>

/// Generates trading signals based on HMA crossovers

/// </summary>

public List<TradeSignal> GenerateSignals(List<PriceData> priceData)

{

var signals = new List<TradeSignal>();

var prices = priceData.Select(x => x.Close).ToList();

var hmaValues = HullMovingAverage.Calculate(prices, _hmaPeriod);

// Ensure we have enough data points

if (hmaValues.Count < 2) return signals;

// Skip first few periods where HMA is calculating

for (int i = 1; i < hmaValues.Count; i++)

{

int priceIndex = prices.Count - hmaValues.Count + i;

decimal currentPrice = prices[priceIndex];

decimal previousPrice = prices[priceIndex - 1];

// Check for crossovers

if (IsBullishCrossover(currentPrice, previousPrice, hmaValues[i], hmaValues[i - 1]))

{

signals.Add(CreateBuySignal(currentPrice, priceData[priceIndex].Timestamp));

}

else if (IsBearishCrossover(currentPrice, previousPrice, hmaValues[i], hmaValues[i - 1]))

{

signals.Add(CreateSellSignal(currentPrice, priceData[priceIndex].Timestamp));

}

}

return signals;

}

/// <summary>

/// Process real-time price updates

/// </summary>

public TradeSignal? ProcessPriceUpdate(decimal price, DateTime timestamp)

{

_priceBuffer.Enqueue(price);

if (_priceBuffer.Count > _hmaPeriod * 2) // Keep buffer size manageable

_priceBuffer.Dequeue();

if (_priceBuffer.Count < _hmaPeriod)

return null;

decimal currentHma = HullMovingAverage.GetLatestValue(_priceBuffer.ToList(), _hmaPeriod);

if (_lastHmaValue.HasValue)

{

if (IsBullishCrossover(price, _priceBuffer.ElementAt(_priceBuffer.Count - 2),

currentHma, _lastHmaValue.Value))

{

_lastHmaValue = currentHma;

return CreateBuySignal(price, timestamp);

}

else if (IsBearishCrossover(price, _priceBuffer.ElementAt(_priceBuffer.Count - 2),

currentHma, _lastHmaValue.Value))

{

_lastHmaValue = currentHma;

return CreateSellSignal(price, timestamp);

}

}

_lastHmaValue = currentHma;

return null;

}

private bool IsBullishCrossover(decimal currentPrice, decimal previousPrice,

decimal currentHma, decimal previousHma)

{

return currentPrice > currentHma && previousPrice <= previousHma;

}

private bool IsBearishCrossover(decimal currentPrice, decimal previousPrice,

decimal currentHma, decimal previousHma)

{

return currentPrice < currentHma && previousPrice >= previousHma;

}

private TradeSignal CreateBuySignal(decimal price, DateTime timestamp)

{

return new TradeSignal

{

Type = SignalType.Buy,

Price = price,

Timestamp = timestamp,

StopLoss = price * (1 - _stopLossPercentage),

TakeProfit = price * (1 + _takeProfitPercentage)

};

}

private TradeSignal CreateSellSignal(decimal price, DateTime timestamp)

{

return new TradeSignal

{

Type = SignalType.Sell,

Price = price,

Timestamp = timestamp,

StopLoss = price * (1 + _stopLossPercentage),

TakeProfit = price * (1 - _takeProfitPercentage)

};

}

}

public class PriceData

{

public DateTime Timestamp { get; set; }

public decimal Open { get; set; }

public decimal High { get; set; }

public decimal Low { get; set; }

public decimal Close { get; set; }

public decimal Volume { get; set; }

}

public class TradeSignal

{

public SignalType Type { get; set; }

public decimal Price { get; set; }

public DateTime Timestamp { get; set; }

public decimal StopLoss { get; set; }

public decimal TakeProfit { get; set; }

}

public enum SignalType

{

Buy,

Sell

}Advanced Strategy Applications

- Multi-Timeframe Analysis:

- Primary trend identification (higher timeframe)

- Entry timing optimization (lower timeframe)

- Confirmation through timeframe alignment

- Hybrid Strategies:

- HMA + Volume Analysis

- HMA + Momentum Indicators

- HMA + Support/Resistance Levels

- Machine Learning Enhancement:

- Feature Engineering using HMA

- Pattern Recognition

- Adaptive Parameter Optimization

Real-World Performance Metrics

- Win Rate: Typically 55-65% in trending markets

- Risk/Reward Ratio: Optimal at 1:1.5 or higher

- Drawdown Management: Enhanced through proper position sizing

- Strategy Robustness: Consistent across different market conditions

Common Pitfalls and Solutions

- False Signals:

- Solution: Use confirmation indicators

- Implement proper filtering mechanisms

- Parameter Optimization:

- Solution: Regular backtesting and validation

- Adaptive parameter adjustment based on market conditions

- Market Condition Alignment:

- Solution: Market regime identification

- Strategy adjustment based on volatility

Conclusion

The Hull Moving Average represents a significant advancement in technical analysis, particularly for futures trading. Its ability to reduce lag while maintaining smooth price action makes it an invaluable tool for both discretionary and automated trading systems. By understanding its proper implementation and combining it with sound risk management principles, traders can leverage the HMA to develop robust trading strategies.